Latest Payments Europe research on the Greek payments landscape reveals an evolving and increasingly digitalised market and provides insights into consumer and merchant preferences and priorities.

ATHENS; October 15, 2024 – Today, Payments Europe published new research on the Greek payments landscape. Based on a survey of consumers and merchants in both physical and online retail, the study reveals a market in transformation: increasingly competitive, digitalised, shaped by evolving merchant and consumer preferences.

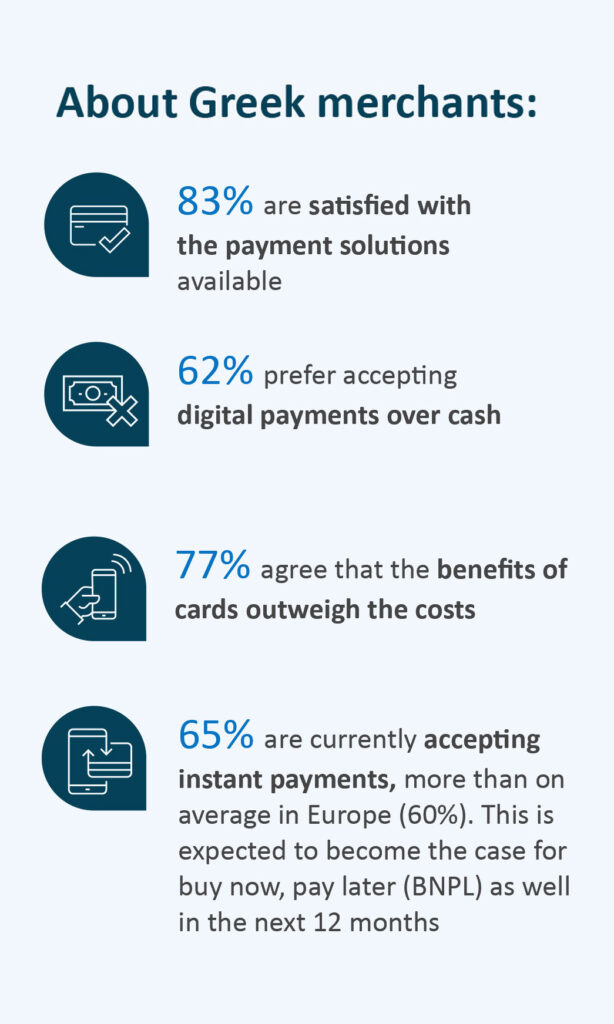

The shift to cashless payment methods is self-evident, despite the fact that cash is often thought to be the preferred payment method in the country. According to the survey’s results, more consumers have relied on card payments than on cash in the last 12 months, and 83% of Greek merchants believe they will be completing more digital transactions in the next year. This trend is even more marked among younger generations, attracted by the growing choice offered by digital payments methods. More than 70% of Greek Millennials and Gen Z expect to increase their reliance on new forms of digital payments in the next twelve months.

Nonetheless, 71% of consumers believe that cards provide more value than other payments methods and 77% of merchants consider the benefits of cards greater than their costs.

Regarding the criteria that consumers and merchants have in mind when choosing between different payment methods, safety and security are their main priorities. When asked to compare different payment options, cards are ranked highest because they are considered to meet those needs best.

The Digital Euro remains rather unknown in Greece, with only 55% of Greek consumers being aware of it. Of them, 46% are unsure what benefits it would bring. On the merchant side, one in three is unsure how the Digital Euro would benefit them or believe there would be no benefit at all.

Robrecht Vandormael, Secretary General of Payments Europe, said: “The shift towards cashless payments continues to accelerate. This latest research shows that the Greek payments story is in evolution and increasingly digital: merchants appreciate the range of payment options, industry is driving advancements and innovation, and consumers enjoy choice and flexibility. Cards remain a cornerstone of the Greek payments landscape, providing safety, security and reliability, while playing an active role in the market’s digital transformation.”

— ENDS – –

This study is part of Payments Europe’s research series: “Safety, Convenience and Choice: The True Value of Cards.” In 2024 Payments Europe commissioned a European survey of 2,250 merchants working in physical and online retail and 13,000 consumers. Read the full report on Payments Europe’s website. Click here for more information.

Methodology

This study is based on a survey commissioned by Payments Europe and conducted in May 2024. The survey was completed by 2,250 merchants working in physical and online retail in Greece (250), Austria (250), Czech Republic (250), Denmark (250), Finland (250), Hungary (250), Ireland (250), Latvia (250), and Lithuania (250).

The survey was also completed by 13,000 consumers living in Greece (1,000), Austria (1,000), Czech Republic (1,000), Denmark (1,000), Finland (1,000), France (1,000), Germany (1,000), Hungary (1,000), Ireland (1,000), Latvia (1,000), Lithuania (1,000), Poland (1,000), and Sweden (1,000). Respondents were weighted on region, gender, and age to ensure representation.

In 2023 Payments Europe also published the results of a survey of 1,560 merchants in Europe. The report is available online: https://www.paymentseurope.eu/truevalue