KEY TAKEAWAYS

- Payments Europe believes the payments industry has a role to play in the decarbonisation of the mobility and transport sector. The proposed Alternative Fuels Infrastructure Regulation is a necessary step to encourage Europeans to move towards electric vehicles (EVs).

- The uptake of EVs will require continuous, seamless, and convenient availability of services, including recharging options. Paying for EV charging should be convenient and secure. Consumers need to be given access to uniform, transparent, interoperable, and cross-border payment options that they know, trust, and are accustomed to.

- We welcome the EC approach that operators of charging station should give users the possibility to recharge with a payment instrument widely used in the EU. Therefore, we recommend that the new regulation requires that card readers are available at all charging stations, regardless of their power output.

- Card readers are easy to implement. Their cost, a small percentage of the overall cost of the charging infrastructure, would quickly be offset by increased number of transactions and existing subsidies for the installation of new charging stations and the acceptance of electronic payments.

The European Union is committed to becoming the first carbon-neutral continent, and, in July 2021, the European Commission (EC) laid the groundwork to achieve this in its “Fit for 55” package Part of the package aims to devise new regulation for mobility and transport. These are recognised as necessary tools for the free movement of people and goods but also identified as polluters with substantial impact on the environment.

Payments Europe commends the EU’s efforts to make Europe a leader in and a driver of the green transition and wants to ensure that the payments industry participates actively in these decarbonisation efforts. In particular, Payments Europe believes the payments industry has a role to play in the decarbonisation of the mobility and transport sector.

HOW PAYMENTS CAN ENCOURAGE THE USE OF GREEN VEHICLES

The EC is looking to transform the current Alternative Fuels Infrastructure Directive (AFID) into a Regulation for the deployment of alternative fuels infrastructure to ensure that sufficient vehicle charging stations exist across the EU[1]. This Regulation is a necessary step to support and encourage consumers’ switch towards electric or hydrogen vehicles whilst also considering the needs of fuel providers and infrastructure owners and managers.

Whichever good or service consumers might want to purchase, payments play a fundamental role and should be facilitators of the process: at any point of sale, the payment experience needs to be fast, convenient, and secure – including in relation to data. If these elements are not guaranteed, shopping is hindered, and purchases are discouraged or abandoned.

The act of purchasing fuel or recharging a battery for a vehicle is not dissimilar to any other purchase consumers make as part of their regular shopping. Hence, paying for charging one’s vehicle should be convenient and secure for everyone, and the act of paying should not become a burden for the consumer. It is with this in mind that fuel providers and recharging infrastructure owners and managers need to ensure that users can access their services in the easiest way possible, striving to make recharging electric vehicles (EV) as easy as it is today to refuel ICE.

HOW CAN THIS BE ACHIEVED?

Consumers need to have access to uniform, transparent, interoperable, and cross-border payment options that they know, trust, and are accustomed to. If this is not guaranteed, paying at charging stations becomes an unnecessary stumbling block for the uptake of green vehicles.

TODAY, BUT ALSO TOMORROW, CARD PAYMENTS ARE RESPONDING TO THESE NEEDS

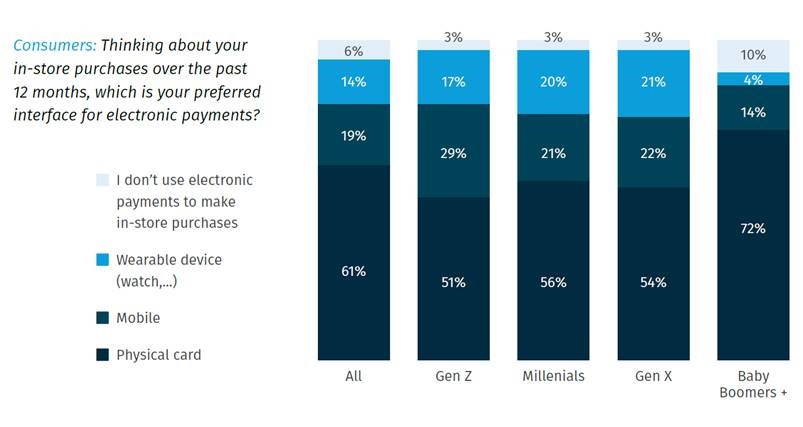

As recognised by the European Central Bank, payment cards are the most widely used electronic payment instrument in the European Union, amounting for more than half of all non-cash transactions. Furthermore, cards are also the fastest growing cashless payment instrument, with the number of transactions more than doubling in the last decade.[2] Payments Europe’s data suggest that payments by cards made up almost half of in-store payments over the last 12 months, and this trend is only going to increase in the next five years. This is no surprise – cards are both consumers and merchants’ favourite payment method as they best respond to their top-rated needs: ease of use, security, and speed.

Card payments are facilitated through physical cards, mobile devices, wearables, and others. However, many people still prefer to pay with a physical card. Contactless has been an important contributor to this. In the past 12 months, contactless card payments were the most used method to pay in stores. The Covid-19 pandemic has likely accelerated this trend, with two out of every three European consumers agreeing they now use contactless more often than before the pandemic, and a similar proportion agreeing that they now actually prefer to pay with contactless. This is likely because contactless payments provide not only benefits which are generally appealing to consumers, such as speed (recognised as a benefit of contactless payments by 52% of consumers) and ease of use/convenience (47%), but also offer advantages which are deemed particularly important during a pandemic (hygiene, 48%).[3]

It should also be highlighted that Payments Europe’s data consistently shows that the value of card payments outweighs their costs[4]. Indeed, thanks to regulation and competition in the payments market, European merchants are benefitting from the lowest card acceptance costs in the world – including when looking at terminal charges.

Looking specifically at the cost of terminal installation at EV charging stations, it must be noted that state-of-the-art near-field communication (NFC) card readers are technically easy to implement and can be realised cost-effectively, making this one-off, fixed cost account for a small percentage of the overall cost of the charging infrastructure.

In fact, data shows maximum payment convenience using “open-loop” payment terminals ensures high frequency of use, which in turn allows for quick amortisation of implementation costs. The expected increase of transactions at charging stations with a terminal for card payments will make it even easier and faster to recuperate the initial investment. Not only the acquiring market is competitive and can count on constant technological improvement and decreasing prices, but also, the transition to EV and growing use and scale-up of EV infrastructure will benefit the wider ecosystem by driving down costs of innovation and supplying the market with more sophisticated solutions.

It should also be noted that the cost of installation would further be offset by the subsidies currently provided at EU and Member State level both for the installation of new EV charging stations and to encourage and support the deployment of infrastructure for the acceptance of electronic payments[5].

Finally, it is worth noting that there is no “free” alternative to the installation of terminals for card payments as developing, installing, and maintaining alternative payment solutions also has relative costs.

Interoperability and common standards for open payments can also give ecosystem players (businesses, municipalities) access to aggregated and anonymised data about demand and customers’ behavioural patterns to help optimally locate different types of charging points in places where consumers would naturally use them more frequently, which would also positively impact business model.

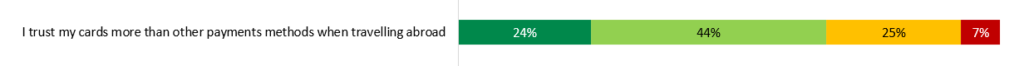

Card payments are also best suited for cross-border payments as they are universally accepted, and, due to cooperation between domestic and international card schemes, can be used in any European country. For this reason, almost 70% of European consumers trust their cards more than any other payment method when travelling abroad.

In line with this, the majority of respondents to the European Commission AFIR public consultation expressed support for card payments to be the main payment method granted at refuelling stations.

PROMOTING CONSUMER CHOICE AND SECURITY

The acceptance of card payments is necessary to truly support changing consumer habits and promote the transition towards EVs, but alone, it will not be sufficient. As already noted above, the uptake of EVs will require continuous, seamless, and convenient availability of services, including recharging options.

The charging infrastructure will grow significantly, and EV charging points will become even more common than petrol stations are today, deployed in more convenient locations (in a few years, Europe will move from having some 93,000 petrol stations to having millions of charging points). A future with EVs offers the possibility for new exchanges and interactions, not only between consumers, EV makers, and energy providers, but also other stakeholders if the ecosystem remains open. A good example of this is the fact is that in the payment experience EV charging space will not always flow through payments at the charging point as ‘click and charge’ services will allow EV drivers to pay for recharging even before they reach a station. Purely web‑based payment options often require consumers to complete the payment process with their mobile devices via corresponding websites/mobile applications, something that is often consumer‑unfriendly and challenged with interoperability issues as well as significant barriers (e.g., slow multi-step processes, exclusion of seniors and less tech savvy consumers, poor customer interface).

For example, promoting open-loop through a contactless system which use EMV Chip cards for payment via cards or digital wallets would enhance the protection of consumer payment data and eliminate the need to pre-register, which is often a burden when using closed-loop proprietary solutions.

Moreover, ensuring that open-loop card payments are the centrepiece of the consumer payment journey would support the development of a truly pan-European interoperable network for EV drivers to enjoy. It would also provide effective consumer choice to European and foreign consumers within the EU.

OUR RECOMMENDATIONS

Payments Europe advocates for competition and consumer choice. For this reason, we welcome the European Commission’s approach in the proposal for a new AFIR to require operators of charging points to provide users with the possibility to recharge their EV using a payment instrument that is widely used in the EU. This offers consumers the possibility to choose from different payment instruments, therefore ensuring they can rely on their preferred payment method.

Nonetheless, we believe that the text of Article 5 of the EC proposal creates unnecessary barriers that will eventually tamper with consumers’ choice when recharging their vehicles at charging points with a power output lower than 50kW. At such less powerful charging stations, the proposal excludes the need to provide a card payment reader. This translates to users being able to pay by card via QR scanning (through mobile) only, a payment method is not widely used yet in the European Union. With this in mind, it is easy to see that this provision contradicts the EC’s own approach.

We therefore call on the EC to adopt the same approach for all charging stations, regardless of their output power. If the new Regulation is to ensure easy access to charging points for all users and across Europe, Payments Europe sees no reason for smaller charging ports not to provide the possibility to pay by card, the most preferred payment method of Europeans.

CONCLUSION

In inviting the EC to recognise the fundamental value that card payments provide to European citizens in all aspects of their lives, Payments Europe calls for AFIR to require that all charging points, regardless of their power output, guarantee the possibility to pay by card. This will ensure ease of use, trust, seamless experience, system reliability, and uniformity across borders, thus reinforcing the European strategy to support the transition to EV. We strongly believe that this will translate into a greener and more sustainable future for the European transport and mobility sector.

[1] More information available at https://www.europarl.europa.eu/legislative-train/theme-a-european-green-deal/file-revision-of-the-directive-on-deployment-of-alternative-fuels-infrastructure

[2] European Central Bank, Card Payments in Europe – current landscape and future prospects: a Eurosystem perspective. Available athttps://www.ecb.europa.eu/pub/pubbydate/2019/html/ecb.cardpaymentsineu_currentlandscapeandfutureprospects201904~30d4de2fc4.en.html

[3] Payments Europe, The Evolution of the European Payments Market: from cash to digital, what do Europeans want?, available at https://www.paymentseurope.eu/wp-content/uploads/2021/11/The-Evolution-of-the-European-Payments-Market_Payments-Europe_Spread.pdf

[4] Payments Europe, Cards in the evolving European payments landscape, available at https://www.paymentseurope.eu/wp-content/uploads/2019/12/Payments-Europe-Report_Cards-in-the-evolving-European-payments-landscape.pdf

Payments Europe, The Evolution of the European Payments Market: from cash to digital, what do Europeans want?, available at https://www.paymentseurope.eu/wp-content/uploads/2021/11/The-Evolution-of-the-European-Payments-Market_Payments-Europe_Spread.pdf

[5] Programmes such as Cashless Poland and a new Belgian initiative allowing all consumers to pay electronically in all points of sale